Let me start by saying that I’m NOT an accounting nerd, but I have a very high regard for accounting nerds like our John Williams.

Let me start by saying that I’m NOT an accounting nerd, but I have a very high regard for accounting nerds like our John Williams.

But, it occurs to me as people are crunching their year-end accounting for marketing costs, they are probably designating marketing investments as “operating expenses.”

What is a Marketing Expense?

Many people take their marketing decisions much too lightly. This may be in part because they commit “random acts of marketing” like exhibiting at a trade show without a proper follow up program, or running a beautiful ad in a glossy aviation magazine without providing a response code or other method of tracking the results.

It’s true that “random acts of marketing” can be wasteful monthly expenses. We’d like you to think about your marketing activities in terms of investing in permanent assets that add lasting value to your company.

Here’s what we mean: We believe that your customer list and your prospect list are, by definition, the most important assets that your company can own.

Since your client list and your prospect list are vitally important assets, then materials and infrastructure that are used to build and maintain these lists are capital investments.

As an example, let’s say that you have a healthy prospect list of several thousand and a client list of several hundred.

If all of your airplanes were (amazingly) wiped out by a tornado and you were (even more amazingly) uninsured; or if (somewhat less amazingly) your product became somehow unsellable because it was overtaken by more current technology, you still have an active file on hundreds of people who already know, like and trust you. You also have an active file with varying amounts of information on thousands of people who have heard of you and have had at least one positive interaction with you.

You can always create another product, or sell someone else’s product that fits the demographic of your client list.

As long as you have customers and prospects, you’re still in business.

On the other hand, let’s say that (amazingly) something catastrophic and unrecoverable happens that wipes out every particle of “like and trust” that your clients and prospects may have for you. Or let’s say that (somewhat less amazingly) that there is a power surge at your office that destroys your phones and computers, including your customer and prospect lists, which were stored on the hard drive of a computer that has been fried to a crisp.

No matter what airplanes you have on the ramp or what inventory you have in a warehouse, you have no way of contacting customers and prospects, and they have no way of contacting you.

Without customers and prospects, you’re out of business.

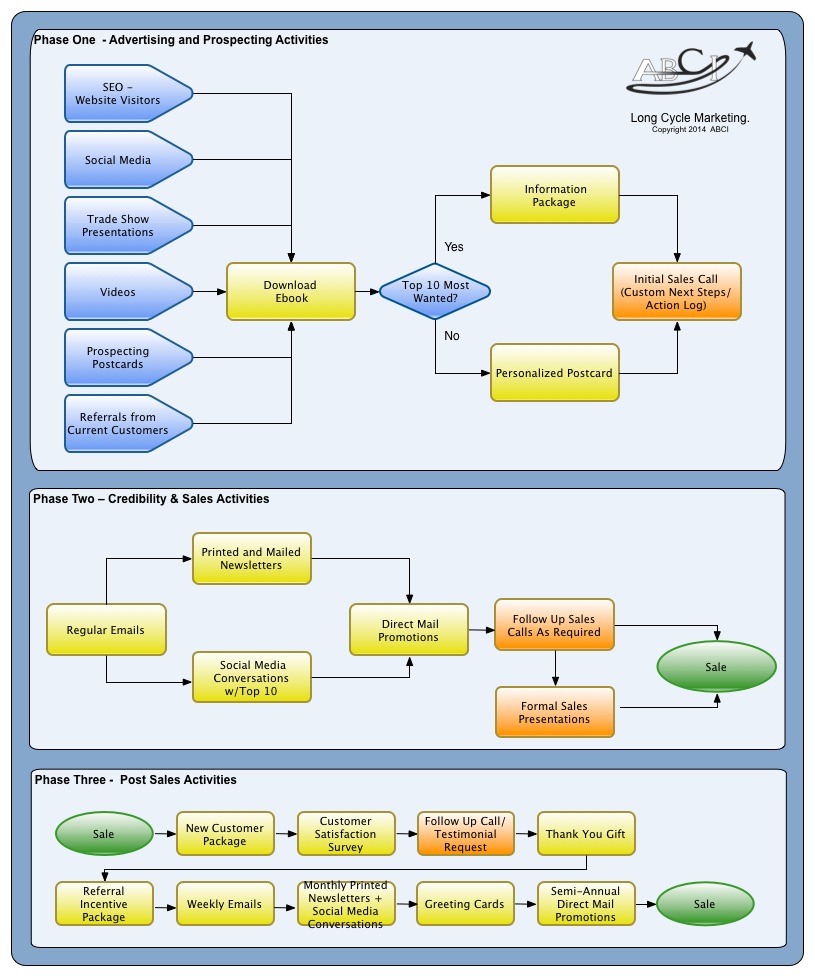

As you can see, your client list and prospect list are the two most vitally important assets your business owns. It follows that activities and infrastructure used to build and maintain these lists are capital investments. Just as an airplane or other piece of equipment can provide good service for years with regular maintenance, a system like the one illustrated can last indefinitely with minor tweaks to various elements.

Example of a Long Cycle Marketing System – A system like this is one of the best investments you can make in the success of your business. Click the image to enlarge it.

Certain marketing materials, like a book, brochure, website, CRM (customer relationship management) software, videos, ebooks and other downloadable products are assets that you can have reprinted over and over again with minor updates. Some of these marketing assets will outlive other, more obvious capital investments that add value to your business.

Note- our usage here includes the first three types listed below.

The Internal Revenue Code, Treasury Regulations (including new regulations proposed in 2006), and case law set forth a series of guidelines that help to distinguish expenses from capital expenditures, although in reality distinguishing between these two types of costs can be extremely difficult. In general, four types of costs related to tangible property must be capitalized:

[5]

1. Costs that produce a benefit that will last substantially beyond the end of the taxable year.[6]

2. New assets that have a useful life substantially beyond one year.[3] For example, in Commissioner v. Idaho Power Co.,[7] the taxpayer used its own equipment to construct and improve various facilities that it owned. The taxpayer sought to have the depreciation of the construction equipment treated as a deduction. The Court held that because the equipment was used to invest in a capital asset – the new and improved facilities – the costs had to be treated as capital expenditures.[8]

3. Improvements that prolong the life of the property,[9] restore property to a “like-new” condition, or add value to the property.[10] For example, in Fedex Corp. v. United States,[11] the taxpayer performed repairs upon jet engines by removing them from the airplane and then having parts replaced. The taxpayer argued that these expenses were deductible, but the IRS stated that the costs should be capitalized. The court held that the inspection and replacement costs could be deducted because the improvements did not add to the value and did not prolong the life of the airplanes as a whole.[12] In Midland Empire Packing Co. v. Commissioner,[13] the taxpayer added a concrete lining to its basement floor to prevent oil from seeping into where the taxpayer stored meat. The taxpayer argued that the costs of installation were deductible and the tax court agreed. The costs of installation only permitted the taxpayer to continue the plant’s operation. The expenses did not add to the value of the business or permit the taxpayer to make new uses of the basement.

4. Adaptations that permit the property to be used for a new or different purpose. In contrast to Midland Empire Packing Co., in Mt. Morris Drive-In Theatre Co. v. Commissioner,[14] under threat of litigation, the taxpayer was forced to create a new drainage system to prevent run-off rainwater from flooding his neighbor’s farm. The taxpayer argued that these costs were deductible, but the tax court disagreed. Because the taxpayer knew in advance the property had an inadequate drainage system, the costs to accomplish this adaptation of the property were a capital expenditure. The costs were not simply an improvement of the preexisting drainage system, but rather a completely new addition to the property that permitted the taxpayer to use the property as a drive-in theater.

Wikipedia

http://en.wikipedia.org/wiki/Expenses_versus_Capital_Expenditures

Need some advice from other sales and marketing professionals? Join us!

.